“Phoenixes burst into flame when it is time for them to die and are reborn from the ashes”

- Professor Dumbledore, Harry Potter Series.

As Professor Dumbledore said Phoenixes are reborn from their ashes. They have been used as a symbol of resurgence quite often. A symbol of old order destroying and a new one rising from its ashes. Quite fascinating for the spectator but definitely chaotic for the Phoenix.

Speaking of chaos, the last couple of years have been nothing short of that. We as part of the branded apparel industry have certainly felt every part of that. However, if one casts their mind back and reflects on the last few years, the insufficiency of the existing business model has been increasingly getting exposed. With each disruption, be it GST implementation or demonetization the wear and tear have gotten more pronounced. But the writing has been on the wall for some time that the current business model is well past its use-by date.

The existing model has served the industry quite well and delivered superlative growth for the companies. The reason for its lack of relevance can be understood by understanding how the industry has shaped up over the years. We will travel through eras and examine what shaped consumption and how companies responded.

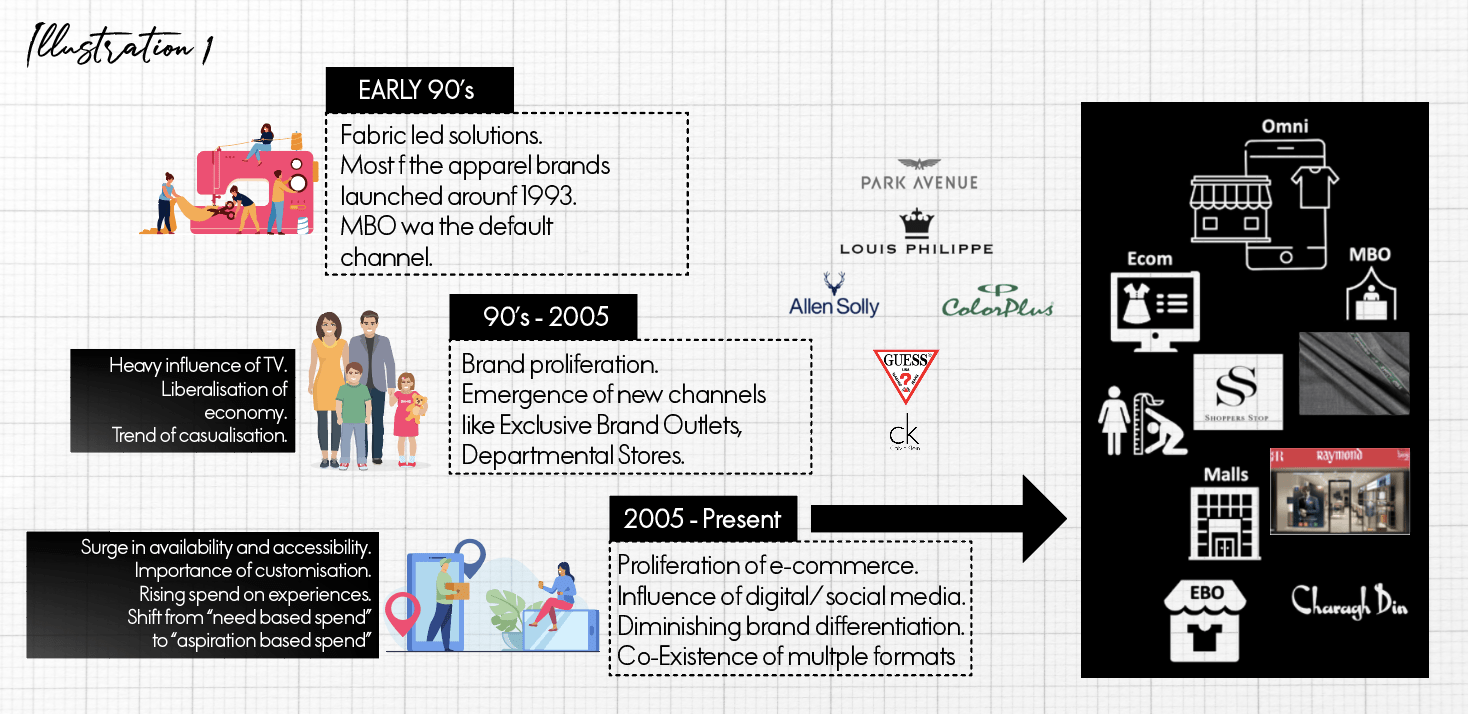

Evolution of the apparel industry

Stage 1: Early 1990s to end of the decade.

Ready to stitch was ruling the roost.

Ready-made garments were a novelty and consumer adoption of ready-made was a hot topic. Slowly the brands started getting seeded in the country. Most of the prominent brands (with a few notable exceptions) were “born” during the period. Multi-brand outlets were the only channels where there was a salesman between the product and the consumer.

The consumer usage occasions were very well defined. Formals were the dress code to the office for most people and casual was something that one didn’t wear to work.

Stage 2: Early 2000s to say 2014

The era of brand proliferation.

Indian consumerism was flying high thanks to the wings of aspirations that had been unleashed. Usage occasions multiplied, dressing norms in the offices started relaxing and we saw the stratification of wardrobe There were now formal, casuals, jeanswear, clubwear, party wear, etc. What this explosion of demand led to –

- Brands expanding through exclusive outlets (certainly with enhanced range and demand feasibility was there)

- Growth of departmental stores

- Heightened activities attracted more players and there were new launches, international brands coming to the country, and multiple brand extensions.

This is the period where brands discovered the now common trade show-based selling model.

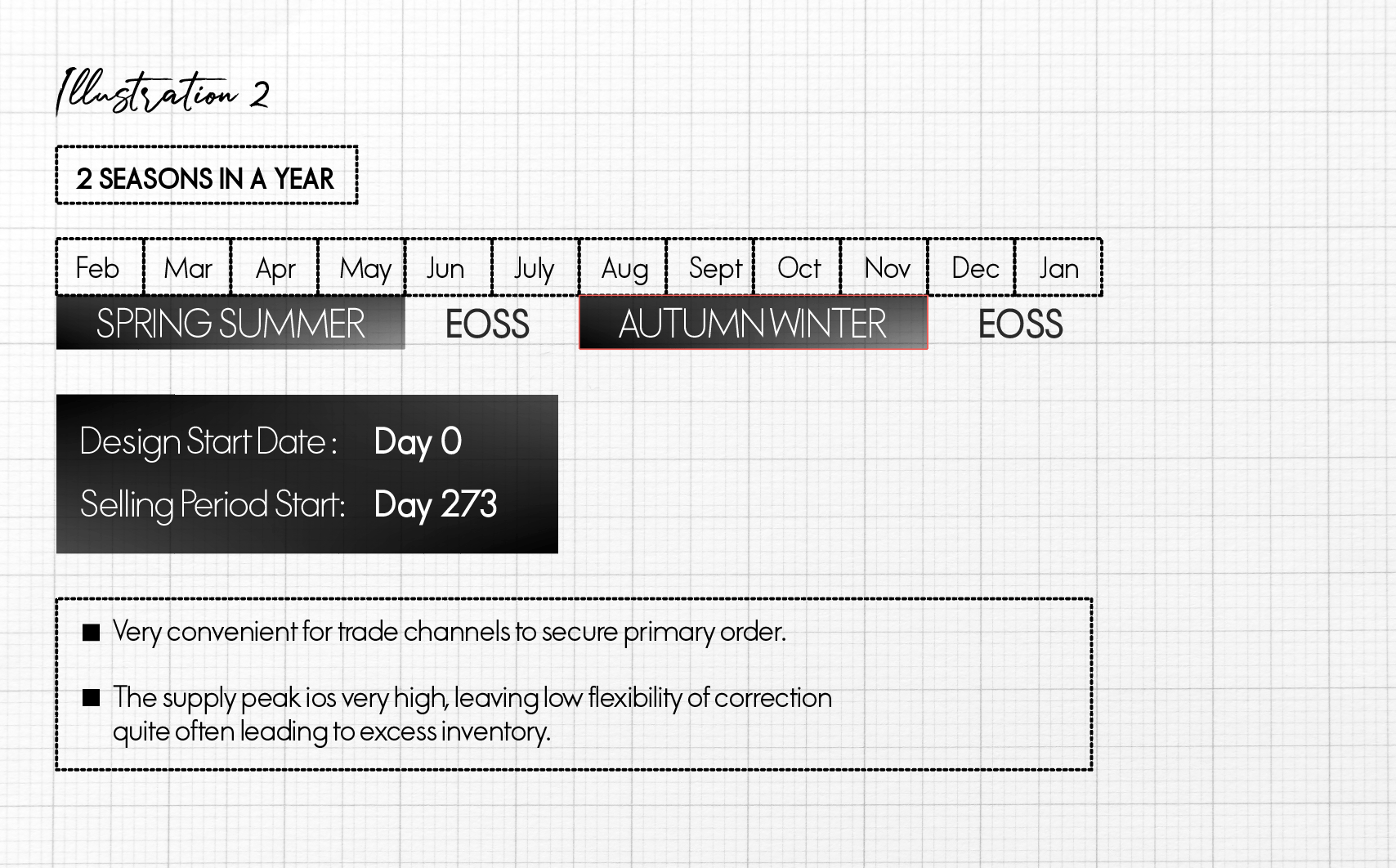

The year broke into 2 seasons -Spring-Summer (Feb-June) and Autumn-Winter (Aug- Dec). For each season the brand would showcase its collection 6 months ahead of the season. (which meant that the design and product team worked on the collection 6 months prior. That made a mind-to-market cycle of 12 months). The customers would place orders and the brand would produce and fulfill those orders. It was a convenient departure from the sell and make model. Allowed brands to lock in large revenues against securities of large orders. Life was all about executing trade shows well. It worked very well as creative booking incentives started getting thrown at retailers’ basis the quantities purchased and trade show became the be-all and end-all of brand’s existence.

Stage 3: Beyond 2014 to now

A real consequence of the frenzy of the last period was that the difference between brands started to diminish and each started looking like the other. This was also a period where e-commerce started making a dent in the consumption space.

The heightened competition and need for growth resulted in – higher discount led sales (End of season sales days have been steadily going up), cost of occupancy (rentals have been up), and an increase in input cost (through currency fluctuation or taxation). The sum total of these factors has led to a massive profit squeeze across companies. No wonder there are a handful of brands in the industry with sizeable scale (greater than 400 crs) greater than 10% EBITDA. The overall profitability in the value chain has been steadily diminishing.

In terms of the key reasons for the model not working are as below-

- Peak of working capital requirement and Cash shortages: It is because the companies want to supply the trade show orders as early as possible. However, consumer sales happen in a phased manner as a result there is always peaking of inventory. The supply happening in bulk means the debtor also peaks. As a result, the gross working capital in the business is always very high. In any kind of disruption therefore the companies across the board find a lot of cash tied up either in inventory or debtors.

- Volatility in Sales and consumer preference: The consumer preference and pathway to purchase has been perhaps fundamentally altered. There are increased volatilities that impact consumption. The full price period (where merchandise sells without any promos or discounts) is hardly existent. The number of days for which the End of season sale is on has touched close to 80 days for the last few seasons. As a result of this, the channels with outright terms are also beginning to behave like consignment channels where the brand has inventory liability. This results in either higher stock returns or higher discounts ultimately killing the profitability.

In sum, the existing model has run out of its applicability. Its high degree of sensitivity to macroeconomic changes and its high reaction time can push companies out of business.

RELATED TOPICS:#Apparel

Leave a comment

Our email address will not be published. Required fields are marked *

11 Comments

Raja ChidambaramAug 02, 2021 at 07:13 am

Hi Suman, Extremely well written article. Some of my thoughts are: (1) This is a disruption; so what worked in the past will not work and totally new approach and business model is the need of the hour. (2) I am remembering a well-known Systems archetype 'Limits to growth' which comes from the principle 'Nothing grows forever'. (3) Peggy Holman in her book 'Engaging Emergence' talks about approaches to deal with disruption. May be a book that may be relevant for leaders in your industry. Thanks for the article, In my association with your industry as an outsider - I have been reflecting on no one in the entire supply chain seem to make money (except the landlord of the stores or malls), may be e-commerce company. Even the person in the garment factory does not make money. Also "REAL INNVOVATION" in this industry for the last 30 years is very low. Even I wonder how much of digital adoption has happened in the entire supply chain. SURELY A WAKE UP CALL FOR EVERYONE IN THIS INDUSTRY.

Amitabh SuriJul 29, 2021 at 07:08 am

Good one suman.

SumanJul 28, 2021 at 20:40 pm

Thanks for your comments

SumanJul 28, 2021 at 20:39 pm

Thanks a lot for your kind words.

SumanJul 28, 2021 at 20:38 pm

Thanks Gaurav! There could be various models for the future depending on the value proposition and consumer segment. However one can safely conclude that a model where one books revenue and profit ahead of final consumer consuming goods is something that's not sustainable.

Praveen ShiggaviJul 26, 2021 at 09:57 am

Spot on Suman sir, I see this write up more as a message rather just an article! Thanks for writing. Offline retailers opened outlet after outlet, e-commerce expanded its reach significantly, all while discounting merchandise that customers refused to buy until it was discounted even more, because most of the customers had learned to shop by the theory, never pay full price!! The blame, therefore must not be put on shoppers, but a model that has been built to make profits for the few. The future looks even more concerned for both retailers & thousands of people who work in the factories, hence calls for a change forcing retailers to offer affordable clothing that are both sustainable & ethically produced. Apart from value creation like improving the company’s cash flow, profitability and having a strong balance sheet, I strongly feel we the industry experts should put pulse around creating excitement, creating fashion, not trying to be the next person to make another flannel shirt. Be the differentiator & always think customer backward.

SumanJul 25, 2021 at 16:17 pm

Thanks KK Sir, I whole heartedly agree with you. The inertia to change and fear of losing in short term is the biggest impediment to change in our industry. Sometimes I am reminded of the story of the frog in water with the water being heated gently. Till the water is lukewarm the frog doesn't mind it but by then its too late. Finally the frog is boiled. Given that so called disruptions are now much frequent, the two traits which are going to separate successful companies from the ones that will perish or just survive are - "Perceptual Acquity", ( I saw this term used by Prof Ramcharan in his book "Attacker's advantage")- meaning the ability to see beyond the bend of the road, and the mind set of urgency to act. Otherwise there would be lot of boiled frogs.

Krishna Kumar (KK)Jul 25, 2021 at 14:21 pm

Hi Suman Interesting analysis and also appreciate your candor that the current model is broken. The current model of tradeshows / seasonal booking followed by most brands was a legacy which started in 90s. The only change is that the trade shows have become more glitzy (pre-covid). COVID has presented a great opportunity to fundamentally change some of the key business processes like demand estimation, range architecture, buying, sourcing etc to bring about agility except that our mindset seems to be the biggest barrier to change. Companies seem to be struggling to come out of the high touch processes which inherently slow down decision making / speed along the value chain. No wonder that the traditional brick and mortar companies seem to be losing ground to the online newbies who don't seem to be saddled with legacy process. Adopting digital technologies is only one of the ways to transform the business but without change of mindsets and bold decision making, a transformational change is not possible.

RayanindyablogsJul 25, 2021 at 16:23 pm

From Suman: Thanks KK Sir, I wholeheartedly agree with you. The inertia to change and fear of losing in the short term is the biggest impediment to change in our industry. Sometimes I am reminded of the story of the frog in water with the water being heated gently. Till the water is lukewarm the frog doesn't mind it but by then its too late. Finally the frog is boiled. Given that so called disruptions are now much frequent, the two traits which are going to separate successful companies from the ones that will perish or just survive are - "Perceptual Acquity", ( I saw this term used by Prof Ramcharan in his book "Attacker's advantage")- meaning the ability to see beyond the bend of the road, and the mind set of urgency to act. Otherwise there would be a lot of boiled frogs. -- Best Regards Suman

GauravJul 25, 2021 at 14:17 pm

Nicely written Suman. Curious to know your views on the future business models specific to this industry

Gulshan KumarJul 25, 2021 at 14:16 pm

Very well articulated & documented the real facts of journey of apparel retails. I will like to complement on such draft, which was very much imprinted in my mind as I have seen changes in apparel industry since 2002 onwards..