THE FUTURE SERIES

Article 6 of 6

The Future of Fashion Vendor

This is the final article in a series of 6 blogs on the changing landscape of the fashion industry and what it means for its various stakeholders. We started this series with changing consumer trends and in this article will come a full 180 degree back to understand how it impacts the the supplier base.

For the purpose of this article, the word ‘vendor’ refers to finished goods, raw materials, trims and other ancillaries which support in the product manufacturing process. The term ‘brands’ shall refer to both fashion and retail companies.

Some relevant topics, like seasons, multiple go-to-market strategies, supply chain pipes, EPLC, digitisation of the disaggregated supply chain have already been covered in previous articles.

In this article, I will discuss how vendors need to

- position themselves to their customers

- structure for flexibility

- plan for additional financing

- become fashion consultants and

- digitise their operations

to remain ahead in this quickly changing world.

So let’s start this discussion by quickly understanding how the brand requirements are changing and from that derive what a vendors strategy should be.

Changing Brand Requirements

There are a few things changing in the fashion world. Brands are looking for the following and are willing to pay a premium for the same.

- Vendors handling smaller volumes with ease

- Vendors taking on some of the brands inventory pressures

- Vendors bringing flexible working on the table in terms of delivery phasing, inventory parking to name a few

- Vendors who are their trend, innovation and design partners

The reasons for the above have been discussed in greater details in the previous blogs.

Having understood the above, let us first see how vendors should strategise to be relevant in the coming era.

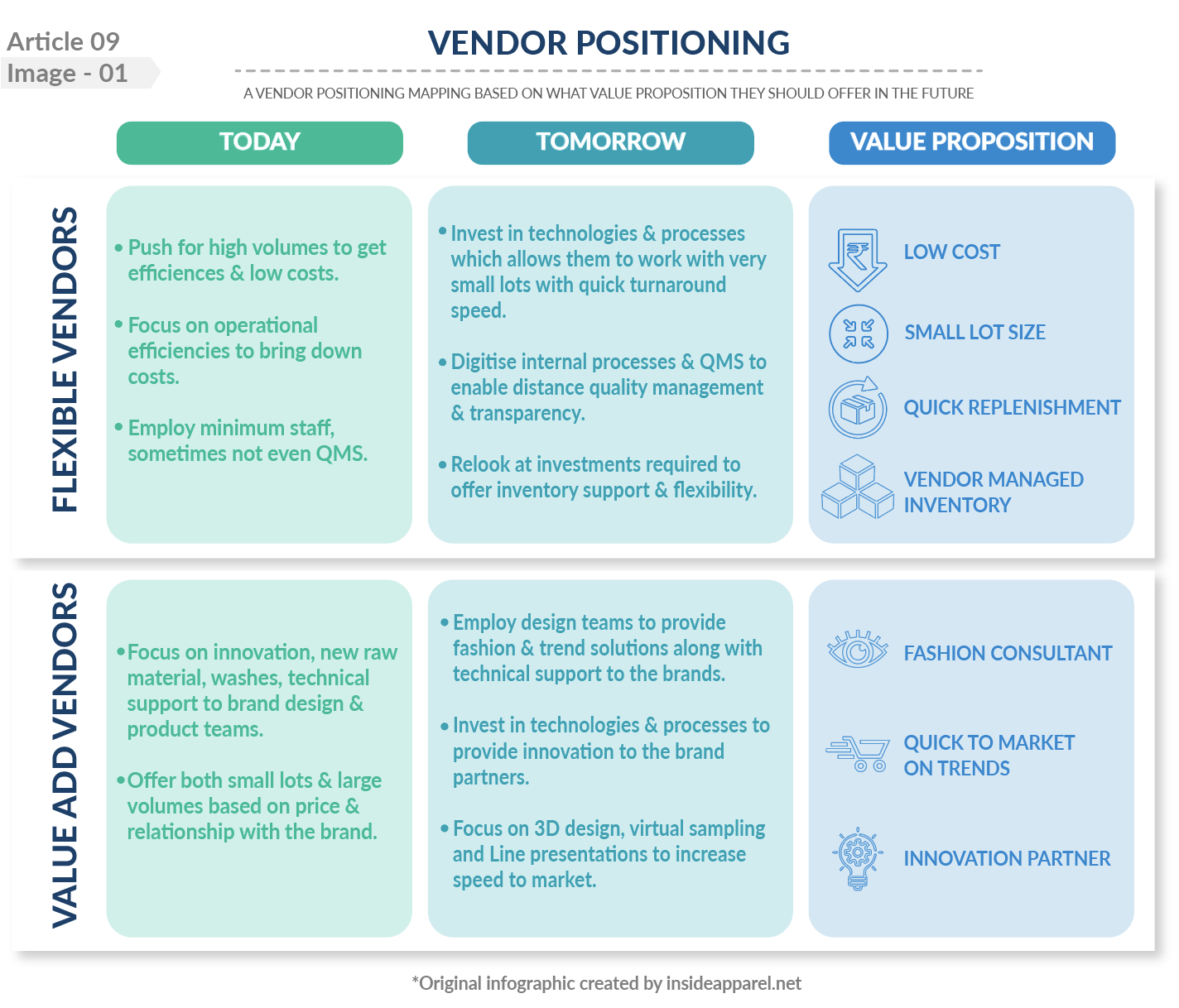

Vendor Positioning

I have a very simple way of looking at this and it’s given in image no.1 below.

There are two other positions available as well (a) the classic low-cost/high-volume vendor and (b) the niche vendor. The lo-cost/high-vol vendor will continue to face growth and uncertainty issues unless they transition to either flexible or value-add vendors.

This takes us to the next point, which is flexibility.

Structure for Flexibility

Vendors like to have orders in hand (sometimes a full seasons orders at a go, helping them fill their order books and planning lines well in advance) to manage their lines well, but brands are no longer able to forecast as before. Hence they are looking at various ways like replenishment, vendor managed inventory and quick turnaround to manage their demand.

Brands want to drive demand based supply, which is closer to market & gives very little time for planning. However, vendors find this uncertainty difficult to manage.

Factories are built for volume, efficiency and cost reduction; this needs to move to flexibility with lot sizes, digital solutions for flexibility and cost optimisation with an understanding of additional services being offered.

To set everyone’s mind at rest I should mention here that, while there will be smaller lots, it does not mean overall volumes will decline. It is just that it will be split into smaller lots. Vendors need to look at how their factories and procurement is organised to meet this. Can they manage quick changes, smaller lots without impacting their overall efficiency?

Let’s now discuss the next point stemming from this, what is the meaning of ‘managing some of the brands inventory pressures’?

Vendor Managed Inventory

In an uncertain market, brands will need to look at different supply chain pipes. These pipes will be supported through platforming of inventory at various stages of the manufacturing process to enable flexibility and speed to market.

Earlier factories used to only look at costs and capacity bookings. They now need to work with their brand partners on inventory management, sales based replenishment and quick to market launches for them.

This brings us to the next point, which is money.

Plan for Investments to secure the Future

It’s an oft repeated question, ‘how are we to invest in all these, it will cost a lot of money’? Yes. But if the vendor clearly positions him/herself as one of the above then - the business relationship will become a partnership rather than a contractual one. This will become an umbilical cord that cannot be quickly cut.

Vendors need to develop a sense of these requirements which a brand has and offer workable solutions rather than going to them with a manufacturing set-up with capacity and cost offerings.

This begs another question, why do vendors need to invest in design?

Becoming Fashion Consultants

It’s important that vendors start offering fashion, trend and innovation solutions rather than products and technology. Brands need quick solutions in a fast changing world. Doing everything yourself takes time.

Vendors managing design and development can ensure quicker go-to-market solutions. This will increase business both for the brand and the vendor and also establish an unshakable position for the vendor.

Being a simple low cost vendor is a commodity which will no longer yield benefits. Brands need solutions - this is where vendors need to pitch.

All this is a big ask. Flexibility means Uncertainty for the vendor. Can they handle so much uncertainty in their business? The answer lies in going digital.

Digitise operations

Factories still operate with analog systems. Even today there are questions around digitisation. So where should factories digitise and why? There are many good factory erp systems available, but factories need to gain scale to be able to afford them. But they must go beyond basic erp systems to look at some cutting edge softwares. Some of these are given below.

- AI based planning optimisation to manage quick change-overs, smaller lots, optimisation of workstations, material handling and integration of departments, allocation and optimisation of cost

- Payroll, upgradation and skill management of workers

- 3D design for quick approvals, virtual sampling and speed to market

- Automation of routine tasks like procurement optimisation, RFQ’s, PO’s - coordination of procurement and follow up for raw Materials

- Digitise quality management systems and compliance data management

And finally providing a dashboard to their customers with live data on status, performance and quality management of styles to build trust and transparency with the customer.

The above can seriously bring in maximum control, lower costs, higher efficiencies and all data available on the click of a button.

Conclusion

In India, vendor bases are small, scaling up is an issue. Labour, regulations, higher cost of capital and rising costs (subject for a future blog) have laid waste to fertile business opportunities. On the other hand brands are getting more and more organised, demanding transparency, dependability, consistency and flexibility.

Can apparel manufacturers survive in this unfriendly environment? This is a question often asked by factories and vendors. Younger generations are not interested in continuing the family business, they feel the return on effort (ROE) is too low.

Caught up in this quagmire, how do vendors grow businesses?

To conclude, I would only say suppliers need to clearly redefine their objective and how they look at themselves. Move from being a provider of products to a provider of solutions and services. They must

- position their business clearly with their customer to stay relevant,

- build long term associations through becoming a solution provider rather than a manufacturer and

- digitise to overcome the uncertainty and challenges thrown up by the system and new market changes.

In the long run Vendors who look at adding value to their customers, either through clever supply chain solutions or design and innovations will continue to grow even in these uncertain times, where their customers are trying to come to grips with the market.

I hope you enjoyed reading this series. We have had some very interesting comments and observations from our esteemed readers. In our next article, we will share some key excerpts from our readers, which will give interesting and sometimes divergent views as well.

Please do write to us in the comments section below and share your thoughts with us. It makes the discussion very interesting and brings to the fore many thoughts.

RELATED TOPICS:#Sourcing,Apparel,Fashion,Preferred Customer,Supply Chain,consumer,fashion industry,Future of Fashion,supply chain strategy,apparel industry,3D Design,vendor base,flexibility,customer,Vendor,Vendor Management,Vendor Strategy,Vendor Positioning,Procurement Strategy,Anindya Ray

Leave a comment

Our email address will not be published. Required fields are marked *

18 Comments

Buy cialis proJan 26, 2024 at 04:48 am

Just desire to say your article is as astounding. The clarity for your submit is just nice and i could assume you're a professional in this subject. Fine with your permission let me to seize your feed to keep updated with approaching post. Thank you one million and please carry on the gratifying work.

cialisJan 04, 2024 at 09:22 am

Thank you a bunch for sharing this with all people you really recognise what you are speaking approximately! Bookmarked. Please also consult with my site =). We could have a link trade agreement among us

CleatteNov 03, 2023 at 13:15 pm

Exemestane Teva can decrease bone mineral density, which may increase your risk of developing osteoporosis cialis online without prescription

Ram SubramaniamJul 20, 2020 at 21:10 pm

Highlighting the fast changes that the market is witnessing, Anindya has brought out the importance of change in mindset that is required across the supply chain.

- Transparency between the various parties involved- I will blame both the vendor and the brand for holding their cards too close to their chests. High time you laid them bare.

- Trust - both parties need to work on this over long periods and interactions

- Need for investment in new technologies and software

- Need for adapting newer approaches to solving problems.

3 and 4 will be futile without 1 and 2. In the book World is flat, the author says 'when you have information you need not carry inventory'. Something i have cherished reading. I have been working on Projects globally. Unfortunately theaverage waste in Projects is more than 10%- still organizations will not train or employ professional Project Managers - will try to cut corners. Thanks for bringing out some known and many unknown ( and swept under the carpet) facts- which are hard hitting- Anindya Well written.R.P.SINGHJul 20, 2020 at 15:32 pm

dear anindya its always been pleasure to review your views and do understand the market was already changing from past 2-3 year but now the responsibility is double for the vendor after covid 19. its fact that most of the vendor do not have sufficient people to handle the Brands/design development or capacity to invest on new innovation .. in this case Brand also need to come forward and share the investment on vendors as we can see Buyer are investing in Bangladesh/vietnam and also guiding them for technology/designing. Brand must visualize the strength of vendor/capacity and try to work with limited number of vendor so you can give maximum number of months load to them and get priority from vendor too.

RayanindyablogsJul 20, 2020 at 18:47 pm

Agree with you RP. It has to a won-win. The important thing is to recognise the goal and direction. Once that is clear the rest will work itself out.

Poonam Sood LalJul 20, 2020 at 13:43 pm

It has always been my view that for a retailers business to flourish the chain including the vendor also have to be profitable . The vendor is a partner in a chain ending at the customer It is therefore very important to understand the vendor . It is my view after 35 years in the Industry that a vendor can only be profitable if he has 2 types of business in this factory --1) core -- 2) fashion .The core has to be low margin hight volume and has to take care of the bread and butter or the salaries of the company .It has to be a constant business and actually a core has to evolve to be cheaper and cheaper year on year .Thats the only way the factory can hold onto the core .So it evolves using raw material ,consumption, or simple productivity by introducing tools to increase productivity The fashion has to have speed to market ,A lean production system ,designers and 3D design technology with MIS systems built in . It is this fashion that will actually bring the customer to the factory and the core will be a support system Why are we not looking at lean manufacturing ? Why are we not investing in 3d Design technology Why don't we have an inbuilt MIS system which can have a live production status on the cloud every morning for the customer to simply log in ?? In todays world unless we evolve both at customer and factory level we are going o find ourselves reduntant and out of business

RayanindyablogsJul 20, 2020 at 18:49 pm

Very relevant insights Poonam. You should contribute to this blog. Maybe we could co-author a few. Would urge everyone to read Poonam's views.

RameshRJul 18, 2020 at 19:42 pm

Dear Anindya, Brands/retailers and (vendors) manufacturing are having 02 different world of thinking / priorities. Unless have a fair understanding on common challenges and confront together, apparel manufacturing may start disappearing from India sooner than we all think. But the organised apparel retail business is here to stay. This article is connecting all the dots from design to delivery landscape. Among all the aspects discussed, i feel one of the important aspect is the existing labour situation from farm to frontend. Which is preventing people to think this industry as an option and do any sort of investments be it expansion, upgradation etc... If it becomes conducive, may attract more home grown business houses and global players. Labour engagement is one of the key factor. We need some holistic approach like, Can union govt. scheme MGNREGA gets integrated with labour intense industries like us? hence it incentives the workforce and entrepreneurs. It will also pave the way for global players to explore greenfield investments. And without a stable apparel supply chain ecosystem with no choice domestic apparel brands and retailers will be forced to look at overseas sources, But govt.policies may not encourage. It is catch 22 situation.

RayanindyablogsJul 20, 2020 at 18:51 pm

What a fantastic suggestion Ramesh. Let us see if this can be taken up at industry level. And our readers are still waiting for your series of articles. Please don't make us wait so long.

Nazmul HuqJul 18, 2020 at 16:58 pm

This series of articles and insights are wake up call for everyone wants to improve in post COVID situation and want strengthen relationships. These series is filled with wisdom, inspiration and practical advises rooted in groundbreaking concepts and the comment on the articles made the series interestingly remarkable. Thank you for sharing and excited to read more in near future.

RayanindyablogsJul 20, 2020 at 18:52 pm

Thanks Nazmul.

Prashanth HVJul 18, 2020 at 14:08 pm

Well written. The need for tomorrow's surveillance of apparel industry is articulated from every stakeholder point. Retail association of India has to first call all brands meeting and divulge a plan for streamlining the way that brands should operate, margins and discounts. If the discount period and amount discount is controlled and all brands agree for the same kind of discount parameters, most of the things for the front end will get controlled. Then the back end and inside the brand also has to be streamlined in the way you have put the forward these articles.

RayanindyablogsJul 20, 2020 at 18:58 pm

Interesting Prashanth. But this is not an ideal world. Every brand, vendor has to do what is right for his/her business. The important thing is to recognise what should be the way forward and then work towards it.

Sanjay LalJul 18, 2020 at 13:35 pm

The apparel and textile industry can be broken down into two major segments. The production of textiles and fabrics from raw materials and the transformation of these fabrics into clothing and other accessories. The textile section of the industry involves taking raw material, converting that material into yarn and then dyeing and finishing the fabrics from yarn. There are many business models for an apparel vendor to follow: -- Original Equipment Manufacturing (OEM) / FOB/Package Contractor. OEM typically manufacture according to customer specifications and design, amd in many cases use raw materials specified by the customer. --Original Design Manufacturing (ODM) or Full Package. A full package garment supplier carries out all steps involved in the production of a finished garment--including design, fabric purchasing, cutting, sewing, trimming, packaging and distribution. --Original Brand Manufacturing (OBM). A business model that focuses on branding rather than on design or manufacturing, this is a form of upgrading to move into the sale of own brand products. For many forms in developing countries this makes the beginning of brand development for products sold in the home or neighbouring countries. -- Assembly / CMT: CMT stands for "cut,make and trim" or CM ( cut and make) and is a system whereby a manufacturer produces garments for a customer by cutting fabric provided by the customer and sewing the cut fabric into garments in accordance with the customer's specifications. India is a full package provider which means that it can carry out all the steps involved in the production of a garment. This included design, fabric purchasing, cutting, sewing, trimming, packaging and distribution. Despite such a flexibility, India has lost its competitive edge. The vendors are a confused lot, not knowing which direction to adopt -- fast fashion or mass production. There are many reasons for India not being able to increase its share of RMG in the global arena. As we know, India has emerged as the largest producer of cotton in the world, and the second-largest exporter of cotton. However, high contamination level and poor quality of fibre, both in fineness and length, are major concerns that need focused attention. China and Bangladesh are the largest importers of cotton yarn from India, who in turn creates value addition to the yarn and then exports the same at a lower cost compared to India. India needs to upgrade its position from a supplier of cotton yarn to a producer of value-added fabrics and garments. While India leads in cotton yarn exports, it has been a very marginal player when it comes to cotton fabric in world exports. China has a substantial share of 51% in cotton fabrics when compared to India’s 5%–6%; the situation is almost the same in case of MMF fabrics. This comparison suggests that India is not able to scale up the value chain significantly enough to meet the global demand despite being the largest producer and exporter of cotton yarn. Approximately 95% of the weaving sector in India is unorganized in nature. The decentralized power loom and hosiery sector contributes 85% of total fabric production. The processing segment is also dominated by a large number of independent, small-scale enterprises. Since, the weaving/processing sector in India is dominated by small-scale enterprises, it has challenges such as inadequate know-how, low focus on research, innovation in new product development and low technology upgradation. Further, low productivity and automation levels also remain one of the biggest woes for the weaving industry. Due to these factors, the overall performance of fabric production in India is getting dampened. The weaving sector still remains one of the weakest links of the Indian textile and apparel industry. India has only 2% share in global shuttle-less looms (i.e. modern looms) installed capacity. The cost of production in India also goes up due to poor technology levels and low scale of operations, as 95% of the weaving sector in India is unorganized and in small scale. India also lacks the presence of large fabric manufacturers when compared to China and the US. The biggest reason is India’s near absence from the main product category that accounts for 70% of world trade in apparels – synthetic apparels. Today, most formal, sports and fashion wear uses synthetic fabrics. They are durable, do not fade, can have any colour. Easy blending with wool, cotton, or rubber allows experimentation. Unsurprisingly, synthetics have overtaken cottons and become favorites of the fashion industry. With weak synthetics, India’s apparel industry is a horse running with one leg tied. The results are low exports, low wages, and low investments in the sector. Globally cotton dominates spring and summer sales seasons. Synthetics and blends dominate autumn and winter seasons. Indian units run six months a year to produce cotton apparels. In the remaining six months, most units are shut or run at a low capacity as they do not have orders for synthetics/ winter wear. Most workers go home. Also, a factory that runs only six months a year still has to pay the full year’s fixed costs – rent, salary for minimal staff, interest on loans, etc. This makes anything made in the factory expensive. Absence from synthetics also affects workers’ wages. Winter wears are more expensive than informal cotton wear. So, at 20% labour cost, a worker making a suit would earn more money than the worker making a blouse. Since India is mainly an informal cotton wear exporting country, wages remain at minimal levels. Entry into synthetics would make factories run full year and increase wages manifold. Now we look towards the second aspect of the industry which is transformation of these fabrics into clothing and other accessories. The weaknesses which are obstructing India to become a major player in apparel sector are primarily because of deficiency in three areas. 1. Reliability. 2. Sustainability and 3. Performance. Reliability parameter implies getting the consignments ordered on time. In general, the consignments which are delivered on time amount to 70-80% of the order and rest gets delayed due to various reasons. Furthermore, the manufacturing base in India which are predominantly handled by small and medium enterprises in terms of production capacity are anemic and suffering from various infrastructural, technological and credit related bottlenecks. These manufacturing industries which are highly labour intensive are not efficient enough to leverage economics of scale thus affecting sustainability and performance. The process of fabric manufacturing begins with a series of steps. The farm to fashion value chain is riddled with various problems within the supply chain.Indian and global fashion designers create products that involve the blends of various fabrics to suit the needs and taste of changing fashion trends. Indian fabric manufacturers are not able to keep up with the demands in time which results in lost orders and buyers shifting th neighbouring countries to fulfill their demands. Piece dyeing is another important area that Indian manufacturers are not able to keep up with due to lack of innovative technology and R&D. Piece dyeing is the ability to blend various yarn (example wool and polyester) into a required length of fabric as per the specifications of the buyers. Availability of good quality accessories such as laces/ labels/buttons/tags and trims are inconsistent and problematic. Sometimes if the required colour of the rib fabric is not matching according to the garment colour, the process of re-dyeing is to be taken up thereby resulting in a loss of two weeks. Consistency of colours is another lacunae within the garment industry. High import cost of latest machines deter many small manufacturers from upgrading to the latest technology, thereby contributing to compromises on quality. Much of pricing in the area of cotton yarn and fabric segment is a reflection of the prices of raw cotton. Pricing of raw cotton is predominantly governed by a few trading houses, thus there is a system of cartelization in the pricing of cotton. In addition, rumors related to poor crop quality and yield leads to further fluctuations in prices. With respect to fabrics since there is a time gap of about 6 to 8 months between order booking and buying season, mill owners are not willing to take a long term view when quoting prices to buyers and thus don't hold on to their prices for long. On top of all above, the problems like, tax distortion, arbitrary conditions, working conditions, clarity on labour laws, shortage if raw materials, lack of technology in the garment industry, lack of sophisticated machinery and many more are quite surprising and unfortunate. The question now arises if the this trade holds any interest for the younger generation? .

Gunish Chander JainJul 18, 2020 at 15:43 pm

Hi Sanjay, well said. Unfortunately garment manufacturing is one of the lowest tech industries. And the margins are low. So when the 1st generation built this and educated their children, the children preferred to venture into newer and advanced industries (tech, services etc.). I feel for this industry to thrive in India, manufacturing has to shift to the hinterlands, new 1st generation entrepreneurs should come up, who have the hunger and desire to make garments. Also, vertical integration with the fabric supply chain is also the need of the hour. that is the only way economies of scale will be built and RMG vendors will have the size and scale to invest in technology.

Gunish Chander JainJul 18, 2020 at 11:51 am

Very Well said Anindya. In order to become a preferred Vendor, I feel a Vendor needs to understand the brand's business. i.e. what challenges the brands face and how as a vendor I can help solve their paint points. At Bluekaktus we focus on digitising the interaction between Brands and Vendors so that the information flow is seamless. A lot of time is wasted in exchange of information between different stakeholders. Through digitization, knowledge can be institutionalized, decision making can be quicker and real time. Some areas of digitization are: Virtual Inspections, Production Planning, Follow up activities, Procurement management and Product Development. Through digitization the productivity in these areas can be improved by 150-300% with a significant reduction in lead times.

RayanindyablogsJul 20, 2020 at 18:59 pm

Thanks Gunish. I can vouch for that. Waiting for your article.